Three VC Worlds, One Year: How the US, India and MENA Are Funding the Future

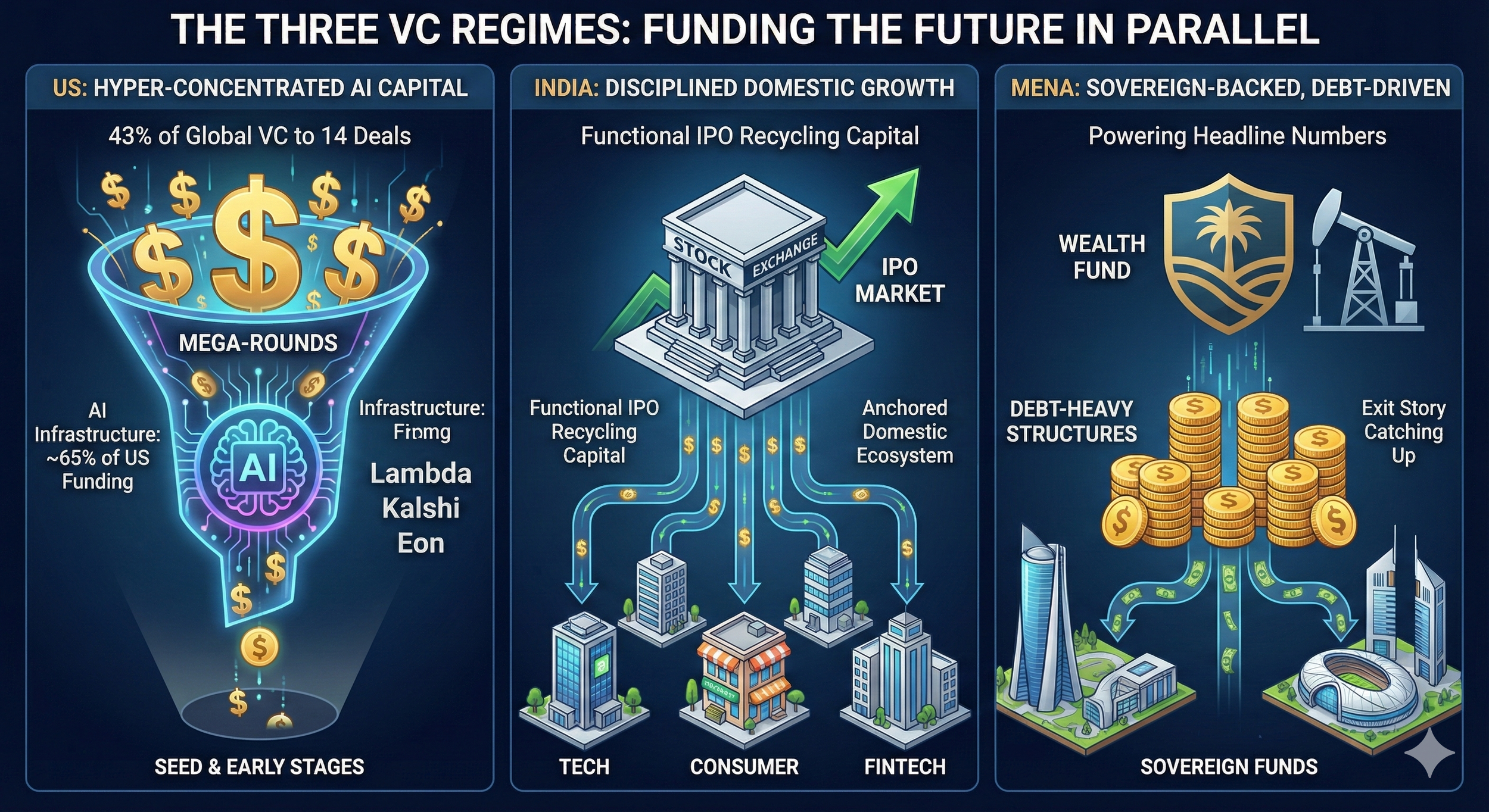

It’s late 2025, and global venture capital has stopped behaving like a single market moving in neat cycles. It now looks like three systems running in parallel.

In the US, capital has gone all-in on AI and deep tech, with mega-rounds and liquid exits keeping the flywheel spinning. In India, venture is more disciplined and domestically anchored, with a functional IPO market quietly recycling capital. Across the Middle East and North Africa (MENA), sovereign-backed funds and debt-heavy structures power impressive headline numbers, even as the exit story struggles to keep up.

Taken together, 2025’s VC and IPO data don’t describe one climate. It describes three regimes: Developed/Concentrated (US), Emerging/Disciplined (India), and Sovereign-Backed/Debt-Driven (MENA).

United States: Hyper-Concentrated AI Capital and High-Confidence Exits

The US is still the gravity well of global venture capital, but its dominance is narrower and more concentrated than in past cycles.

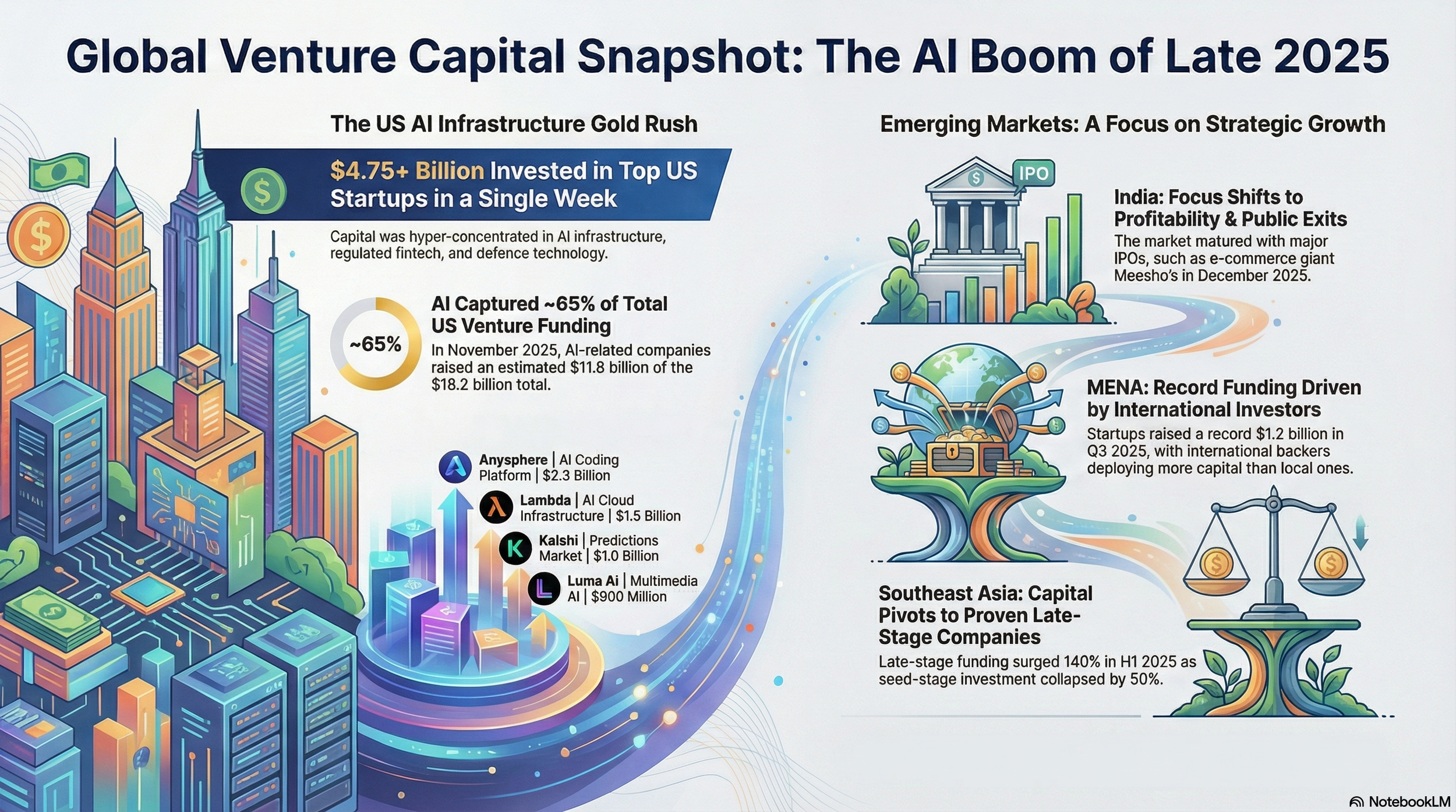

In November 2025 alone, US startups raised about $18.2 billion across 409 deals, more than 70% of global venture funding that month. Roughly 70.6% of that went into late-stage deals, with a small cluster of mega-rounds soaking up an outsized share of capital. One Crunchbase review estimates that around 43% of global venture funding in the period went to just 14 mega-rounds – a sharp picture of how capital has pooled at the top.

The thesis driving this is blunt: technological supremacy and market dominance, with AI industrialisation at the core. AlleyWatch estimates that AI infrastructure alone accounted for about 65% of US funding in November – around $11.8 billion – much of it flowing into compute capacity and foundational tooling.

Lambda’s $1.5 billion round is the purest expression of this bet: a giant financing for the hardware and infrastructure needed to power AI across industries. Crunchbase’s late-2025 trackers add more texture, highlighting deals like Kalshi’s $1 billion financing in prediction markets, and Eon’s $300 million Series D in cloud data, alongside deep-tech and defence-focused rounds such as Castelion’s $350 million Series B.

This isn’t a one-off spike. A Q3 2025 Crunchbase report shows that US companies attracted just under two-thirds of global venture capital, as overall funding jumped 38%, again driven heavily by large AI deals. Separately, The Tech Buzz notes that 49 US AI startups raised $100 million or more in 2025, matching 2024’s record pace and reinforcing the sense of a market in hyperdrive around frontier models and infrastructure.

Structurally, the US is operating as a barbell market. At one end, vast sums chase late-stage AI and deep-tech giants. At the other end, there is steady seed and early-stage activity as founders and funds plug into the same AI narrative. The “missing middle” of growth-stage equity matters less when participants believe the exit door is open and there’s always a bigger round or buyer down the line.

On liquidity, that belief has support. A mid-year Crunchbase report on North America points to a sharp acceleration in exits, with Q2 2025 marked by multiple $1 billion-plus acquisitions and high-profile IPOs from companies like Circle and Chime. DealPotential’s “Startup Trends 2025” mid-year update adds that M&A activity rose about 155% in the first half of 2025 compared with the prior year, giving investors a real alternative to the sometimes uneven IPO window.

So the US model in 2025 is clear: hyper-concentrated capital, frontier-tech bets, and still-credible exits. The risk is high, but so is the perceived upside. As long as public tech multiples and strategic appetite hold, the machine still knows how to pay out.

India: Disciplined Resilience and a Working IPO Ladder

India’s 2025 venture story is quieter but structurally stronger than the fireworks elsewhere imply. It is less about monster rounds and more about stamina, discipline and domestic depth.

Inc42’s analysis of fund formation shows over $12.1 billion of new VC and private equity funds launched in India in 2025, a 39% year-on-year increase. Crucially, about 58% of this new capital is aimed at early-stage companies, signalling a deliberate tilt toward seed and Series A rather than late-stage valuation games. Rather than pile into the top of the stack, India is thickening its base.

The core investment thesis leans on domestic consumption, policy alignment and proven business models. TICE’s December “Dispatch” describes an ecosystem entering a more mature phase: larger cheques paired with tighter cost management and more disciplined boardrooms – a conscious shift away from unchecked burn and growth-at-all-costs.

Sectorally, fintech remains a core pillar as digital payments, lending and wealth platforms seep deeper into India’s middle class. Cleantech and EVs have moved from the margins to the centre of the funding mix. Inc42’s early-December 2025 funding recap notes that cleantech led sectoral funding that week, with about $51 million raised, including a $45 million round for electric mobility player Ultraviolette. Enterprise tech and SaaS continue to attract capital seeking globally scalable revenue streams built on relatively low-cost local engineering talent.

Where India truly stands out among emerging markets is on exits.

IPO Ji’s guide to the main December 2025 listings reads like a long-awaited late-stage cohort finally stepping into public markets. Meesho’s IPO dominates the conversation: Groww’s coverage and Inc42’s reporting show the offering was oversubscribed 79.03 times, a strong signal of public-market appetite for scaled Indian internet businesses.

Alongside Meesho, IPO Ji highlights listings or planned offerings from Fractal Analytics – often framed as India’s first AI unicorn to go public – and consumer electronics brand boAt, suggesting that the pipeline spans both deep tech and mass-market consumer brands rather than being confined to a single sector.

Behind those marquee names, the broader exit engine is actually running. Ecosystem trackers cited by Inc42 and TICE count more than 110 startup exits in the first nine months of 2025, across strategic acquisitions and public listings. Combined with the surge in new fund launches, this points to a system where capital can move in a real loop: from LPs to funds to startups, and back via IPOs and M&A, rather than staying trapped in perpetually marked-up private portfolios.

India’s configuration in 2025 is best described as Emerging/Disciplined. Volumes do not match those in the US, but the country offers a broad early-stage pipeline, sectoral diversity, and a functional IPO ladder. The ecosystem is increasingly able to validate itself without relying on a handful of outlier mega-deals to prove it is “real”.

MENA: Sovereign-Backed Momentum and a Debt-Heavy Engine

In the Middle East and North Africa – especially Saudi Arabia and the UAE – 2025 has been a breakout year in headline terms.

According to MAGNiTT data, MENA venture funding reached a record $1.2 billion in Q3 2025, with Saudi Arabia and the UAE accounting for about 91% of that total. For the first time, the region overtook Southeast Asia in quarterly funding volume, a psychological milestone for policymakers and founders who have spent the past decade trying to put MENA on the global venture map.

But in this region, how capital flows is as important as how much.

A Wamda report on October 2025 activity notes that MENA startups raised $784.9 million that month, and around 72% – roughly $567.8 million – came from debt financing. A single transaction, Property Finder’s $525 million debt round, explains much of that skew. MAGNiTT’s Q3 commentary frames this as part of a broader pattern in which mega-deals and structured, often debt-linked financings drive a significant share of total volume, underpinned by sovereign strategies and large corporate balance sheets.

The underlying thesis across the Gulf is anchored in sovereign stability, top-down digital transformation and inbound strategic partnerships. One illustrative example, slightly adjacent to pure-play startups, is US-listed LZ Technology (NASDAQ: LZMH) signing heads of terms with UAE-based Red Dune Capital to leverage government and real-estate networks across the UAE, Saudi Arabia, Qatar, Kuwait, and Egypt. It’s a good snapshot of how global tech and capital increasingly plug directly into Gulf-backed platforms.

Sectorally, the region’s venture activity reflects those priorities. AI and deep tech led November 2025 funding in value terms, with more than 80% of capital going into AI-linked deals, including US-associated companies such as Luma AI. Gulf sovereign funds are simultaneously acting as limited partners in global vehicles and as direct investors into deep-tech and AI platforms.

By deal count, fintech remains the most active category over the first nine months of 2025, as governments push to digitise financial services and reduce dependence on hydrocarbons. Proptech has surged in value, driven by financings tied to government-backed real-estate and smart-city projects, with Property Finder the most visible example.

In terms of stages, MENA superficially resembles the US: large, strategic late-stage rounds surrounded by a long tail of smaller cheques. But there are real signs of a mid-stage pipeline taking shape. MAGNiTT data suggests Series A and B funding rose 205% year-on-year in the first nine months of 2025, indicating growing investor confidence in companies that have started to prove product-market fit and scalability, not just pitch-deck potential.

The main structural question remains.

In an Inc. Arabia interview, MAGNiTT’s Philip Bahoshy notes that M&A deals doubled year-on-year in the first nine months of 2025, as local incumbents and regional champions began acquiring younger startups more actively. At the same time, he is explicit that exits are still one of MENA’s weakest points. Regulatory reforms in Saudi Arabia and the UAE have opened the door to more IPOs and regional exchanges are vocal about wanting tech listings. However, the data still shows early, uneven progress rather than a robust, repeatable exit engine.

For now, MENA’s configuration is best described as Sovereign-Backed/Debt-Driven: strong inflows, bold strategic bets and improving M&A, but an IPO story that remains more aspirational than proven.

Three Regimes, Three Risk–Reward Profiles

Seen side by side, the divergence between these three markets is blunt.

The US regime is developed/concentrated. The volume story is dominated by mega-rounds in AI infrastructure and deep tech, with a handful of enormous financings and dozens of $100 million-plus AI deals setting the tone for everyone else. The reward is access to frontier technologies and a still-functioning exit stack of IPOs and billion-dollar M&A. The risk is exposure to a crowded, capital-intensive race whose economics depend on the continued health of public tech multiples and, in parts of the stack, government and defence demand.

India sits in the Emerging/Disciplined regime. Its defining feature is capital formation and restraint rather than spectacle. The $12.1 billion in new funds, the early-stage bias, and the 110-plus exits recorded in the first nine months of 2025 together describe a system trying to harden itself: reset valuations, protect margins and still produce public-market-ready companies like Meesho, Fractal Analytics and boAt. Investors are consciously trading some upside optionality for resilience and domestic depth in a market where IPOs are becoming a normal outcome rather than a rare event.

MENA represents the Sovereign-Backed/Debt-Driven regime. The upside lies in sovereign-backed transformation programmes, access to large government and quasi-government projects, and the ability to tap structured capital – including debt – at scale. Record quarters, mega-deals, and the 205% surge in Series A and B funding suggest genuine momentum and a thickening mid-stage pipeline. But the risks are concentrated around exits: an ecosystem where IPO ambitions run ahead of IPO reality and where liquidity still leans heavily on a small circle of strategic buyers and sovereign-linked acquirers.

For founders and investors, this is not just a tidy framework; it is a map of where different kinds of risk live. Building in the US in 2025 means betting on frontier technology inside a machine that still knows how to pay out. Building in India means betting on disciplined growth and domestic density inside a system that is slowly normalising tech IPOs. Building in MENA means hitching yourself to sovereign capital and long-term national projects, with the understanding that the exit chapter is still being written in real time.

The global VC market of 2025 is no longer one story with local footnotes. It is three parallel narratives – concentrated, disciplined and sovereign-backed – each trying to write the future of technology in very different ways, backed by very different kinds of capital.