Why Startup Funding Looks Healthy in the US, Cautious in India, and Fragile in the Middle East

The first ten days of January are a misleading place to hunt for optimism. Deals trickle in unevenly. Disclosures lag reality. One large round can distort the picture. But early-January funding still matters — not because it predicts the year, but because it shows where capital feels safe resting before the noise begins.

Look closely at funding activity across the United States, India, and the Middle East in early January 2026, and a clearer story emerges. This is not a risk-return. It is not a freeze either. It is capital sorting itself by geography, stage, and tolerance for uncertainty. The market is not moving together. It is fragmenting.

The US: Capital Is Flowing, But Only to Familiar Risk

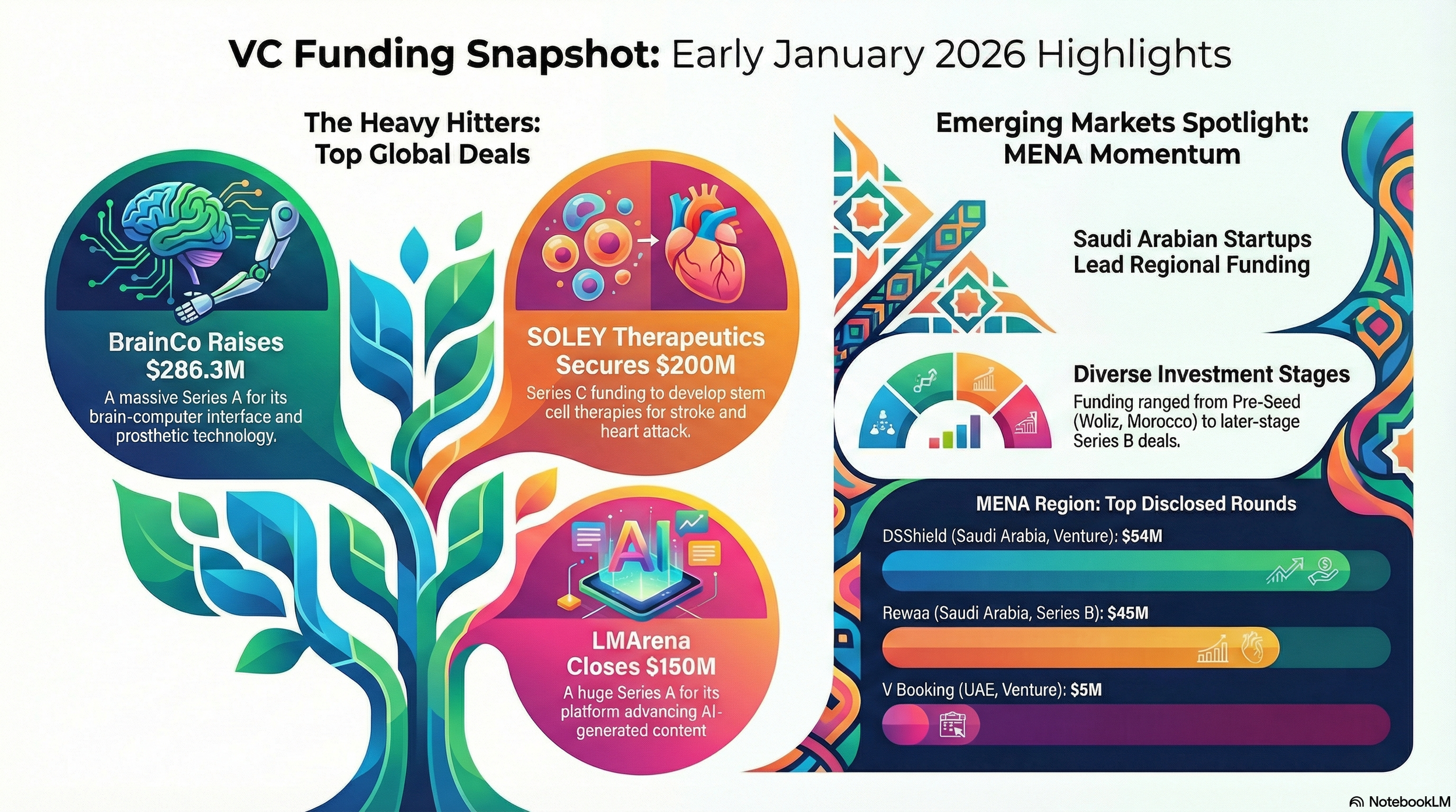

By volume alone, the United States dominates the dataset. In a matter of days, disclosed funding crosses the billion-dollar mark, driven by a small number of very large rounds. At first glance, this looks like a strength.

However, the pattern underneath is narrower. Most of the money is concentrated in later-stage or institutionally legible sectors: life sciences, oncology, medical devices, health platforms, and enabling AI infrastructure. Series C, D, and even Series F rounds appear — but almost exclusively where investors have decades of underwriting experience and established exit pathways.

This is not speculative capital returning. It is continuity capital protecting positions it already understands.

The US ecosystem is still willing to carry scientific and technical uncertainty — expensive labs, long timelines, regulatory risk — but it is far less willing to carry market ambiguity. These are businesses where failure is costly but familiar, and where investors know how to wait.

The presence of AI in the dataset reinforces this caution. AI appears mainly as infrastructure or applied tooling, not as open-ended consumer or narrative-driven bets. Even here, curiosity has been replaced by discipline.

The US market looks active. Psychologically, it is conservative.

India: Less Noise, More Constraint

India’s funding picture sits between the US and the Middle East, but it behaves differently from both. Deal sizes are smaller, headlines quieter, and sector choices more grounded. Yet the range of stages — from seed to Series D — signals that scale-ups still exist, even if they are growing without spectacle.

What stands out is not what is present, but what is absent. There are no narrative-driven mega-rounds. No momentum trades. Instead, capital is flowing into fintech, agritech, and applied enterprise platforms — sectors tied to domestic demand, logistics, and measurable outcomes.

Indian investors appear willing to underwrite execution risk — distribution, operations, unit economics — but with tight boundaries. Cheque sizes are controlled. Expectations are clearer. Survival is valued as much as growth.

In the global context, India looks like a market that internalised the last funding cycle’s correction earlier than most. The adjustment has already happened. What remains is selective endurance.

The Middle East: Many First Cheques, Few Guarantees

The Middle East tells a structurally different story. Deal count is relatively high, but capital per deal is low, and activity clusters overwhelmingly at the pre-seed and seed stages — especially outside Saudi Arabia and the UAE.

Saudi Arabia is the outlier. It functions as the region’s capital anchor, producing the largest disclosed rounds and absorbing risk that other markets cannot. The UAE follows with steady early-stage activity, though at smaller scales. Beyond that, Egypt, Morocco, and Syria show signs of ecosystem formation rather than consolidation.

This is not a weakness. But it is fragile.

Most of this capital is underwriting ecosystem uncertainty: whether markets mature, regulations stabilise, talent concentrates, and follow-on capital appears. That uncertainty keeps cheques small and stages early. It also means many companies will reach a funding ceiling quickly.

The Middle East is building breadth before depth. That is natural — but it comes with exposure when global risk appetite tightens.

The Pattern Beneath the Numbers: Risk Has a Geography Again

Taken together, the three regions reveal a deeper pattern. The difference is not optimism versus pessimism. It is what kind of uncertainty investors are willing to tolerate. In the US, capital is comfortable carrying long-term technical risk, but only in sectors with institutional memory.

In India, the capital tolerates execution risk, but demands economic clarity early. In the Middle East, capital absorbs foundational ecosystem risk but avoids long commitments until the system proves itself.

This matters because venture capital was once sold as borderless. The 2021 narrative suggested risk could be exported anywhere with enough ambition. That idea has quietly collapsed. Geography matters again.

Stage Distribution Tells the Real Story

The maturity of an ecosystem is better revealed by stage distribution than by total dollars raised. The US shows continuity from early to late stages, at least for certain categories. India shows a functioning but disciplined pipeline, with fewer blow-out outcomes, and the Middle East shows heavy early-stage activity with thinner paths to later rounds.

When early-stage deals outnumber mid-stage ones, it often signals enthusiasm without infrastructure. It looks like momentum. It behaves like attrition.

Concentration Works Differently Everywhere

Capital concentration exists in all three regions, but for different reasons. US hubs function as compounding engines: dense investor networks, repeat founders, and deep follow-on pools. Indian hubs are more distributed, tied to operational ecosystems rather than investor gravity alone. Middle Eastern hubs are policy- and platform-anchored, shaped heavily by state involvement and regulatory clarity.

Each model produces startups — but not the same kind of survivors.

The Quiet Warning in the Chart

The funding chart itself hints at a final pattern: large totals driven by a small number of rounds. This is a classic post-bubble condition. Capital has not returned broadly. It has concentrated.

For founders outside the narrow lanes of institutional comfort, the market may still feel frozen — even as headlines suggest activity.

Early-January funding is not a forecast. But it is a mood. The mood right now is cautious, selective, and uneven. The global startup market is not recovering in sync. It is reorganising around risk tolerance, institutional memory, and geography.

The myth of a single global venture cycle is fading. What replaces it is a world where you build, what you build, and which uncertainty you ask investors to carry matters more than it has in years. That is the real signal hiding beneath the numbers.